There are no hidden-fees and your account manager will guide you every step of the way. invoice factoring jobs in california Credit Analyst- Asset Based Lending. Factoring companies are more concerned about the credit worthiness of your customers, since they’ll be the ones paying the invoices! If you’re looking to build or improve your credit, invoice factoring is a great option! Additionally, because factoring is not a loan, there will be no negatives on your balance sheet, or interest to re-pay. Invoice Factoring is most beneficial to companies that are either financially challenged or still in the process of building momentum that dont qualify for. When you factor, you’ll receive up to 98% of your total requested funds, and cash disbursements are available within hours.Īlso, unlike conventional loans, credit checks on your company aren’t necessary. California invoice factoring is fast After completing an application, approval to begin factoring is generally a few days. If the bank approves you, you may not get all the capital that you need. The approval process is cumbersome and can take weeks or months.

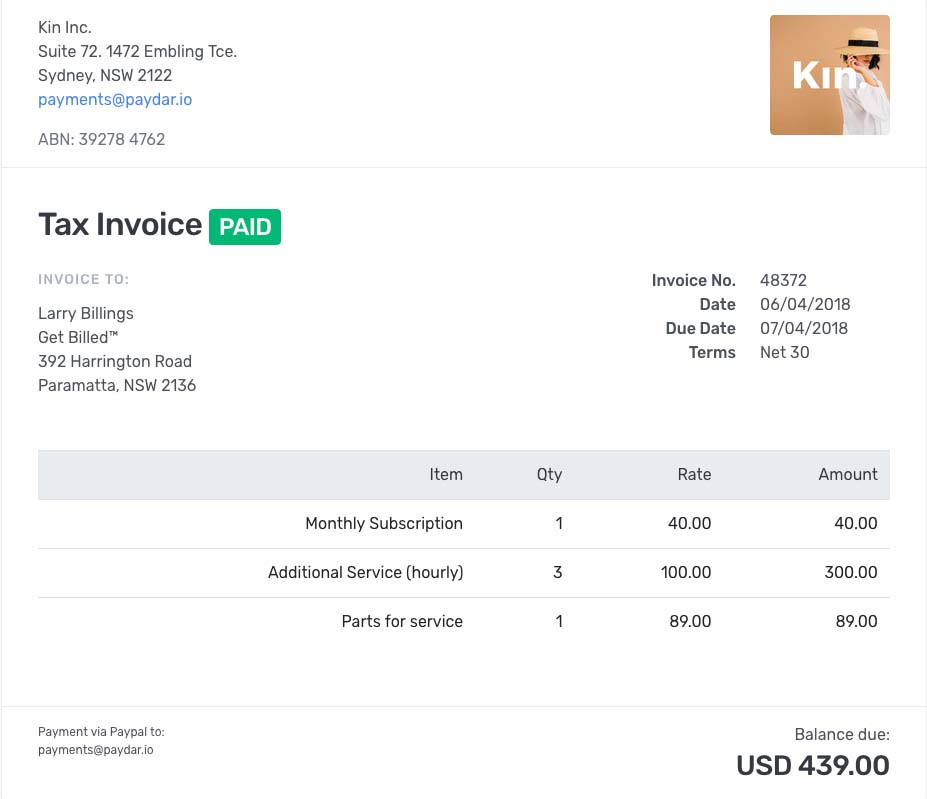

Our services include business loans, invoice. First, a California factoring company purchases your outstanding invoices, giving you between 70-98 of its face value within 24 hours of submitting the invoice. Primary Funding provides small to mid-sized businesses with alternative business financing since 1995. Because of strict banking regulations, traditional loans are difficult to obtain. Invoice factoring, which also goes by accounts receivable or business factoring, is a very simple, comprehensible process. Factoring companies help businesses meet obligations and grow by purchasing their receivables and advancing a percentage of the invoice amount on the same day. In other words, Loves Financial buys invoices for the loads youve already delivered then collects from your customer. Benefits of Choosing a California Factoring CompanyĬalifornia invoice factoring is fast! After completing an application, approval to begin factoring is generally a few days. Invoice factoring, also known as accounts receivable factoring, is a common solution many California companies use to get the financing they need to operate successfully.

0 kommentar(er)

0 kommentar(er)